Logistics Update

As any roaster knows, planning ahead is the key to a successful coffee program. This is particularly true as changing weather patterns continue to bring unpredictability to coffee seasons, and global events cause supply chain disruptions. With several containers recently booked and hitting the water, we’ve compiled an update of the logistical challenges our industry is currently facing, and an overview of what to expect next for our coffee offerings.

Read on for more information, or get in touch anytime to chat with our team.

Published 29 Oct 2024

The last twelve months have been a roller coaster for the coffee industry. After a period of relative stability in the global coffee market, prices spiked to historical highs in mid-2024, driven by increased cost of production, devastating climate events and market speculation, impacting the ready availability of specialty-grade coffees and prompting many buyers to explore alternative strategies to secure accessibly priced coffees. At Melbourne Coffee Merchants, we’ve stuck true to our core values of prioritising relationships and taking an uncompromising approach to quality, which, ultimately, means paying higher prices — representative of the true cost of producing exceptional, traceable and responsibly sourced coffee lots. Despite this, we’ve worked hard to maintain the marketability of our offerings in the Australian industry, by creating efficiencies in our own supply chain, adjusting our margins and managing our costs more effectively.

While we’ve taken every precaution to book and sail the offerings we sourced across June-September as quickly as possible, disruptions to global shipping routes have created delays for our incoming shipments, particularly for those that typically land around the turn of the year.

There are a few reasons behind the delays experienced across international ports:

- In Brazil, a delayed harvest resulted in a more compressed shipping period, leading to excessive stock hitting the Santos port (where most of the country’s coffee exports depart from) at the same time. The port remains congested, with most containers facing delays of several weeks because the majority of incoming ships are not able to take on extra cargo, and many are choosing to skip docking in Santos entirely. While this is causing some delay with our later containers, we’re happy to report that our blending lines are already en route to Sydney, Perth and Melbourne ports and due to arrive before the end of the year.

- Across the Panama Canal, a severe drought in early 2024 resulted in low water levels, meaning fewer ships were able to travel through the canal for several months. While an early arrival of the rainy season helped conditions improve (at their worst, some affected shipping companies diverted their freight to rail lines that run parallel to the canal), the effects of water shortages continue to impact shipping capacity in this important thoroughfare. All backlogs, regardless of their location, affect the number of usable containers and vessels available at any given time, and the ripple effects of this drought are still contributing to the container shortage being experienced across the globe.

- Ongoing conflict in the Red Sea has diverted traffic from the Suez Canal, which serves as shortcut between Europe, Asia and the US. Many major shippers have chosen to protect their staff and freight by taking the longer journey around the continent, adding anywhere between 12-20 days to the route. This, in turn, has caused container shortages in ports along the Horn of Africa. Depending on how long the conflict continues, this may lead to significant challenges in shipping our 2025 Ethiopian offerings. We’re keeping a close eye on the situation and working with our supply partner, Testi Specialty Coffee, to plan and move our shipments as efficiently as possible.

- The Red Sea conflict has forced many vessels to reroute, leading to intense congestion at various ports in Asia that are docking extra shipments. Many countries, like Singapore and Malaysia, are experiencing delays not seen since the peak of the pandemic.

- Although Colombian exports are moving smoothly out of the country, a rise in the price of diesel fuel led to a truck driver strike in September 2024, slowing down the transit of coffee internally. While the government was able to negotiate a return to operations, the threat of further strikes remains as long as fuel prices remain high. Our long-term supply partners, Pergamino, are on-the-ground and managing domestic transport to avoid delays in our final shipment for 2024.

- Increased costs of fuel and labour, and the inaccessibility of trade routes like the Panama and Suez canal have seen shipping rates soar, affecting our costs across the board. Our team is managing these costs closely, and finding efficiencies to avoid passing significant price increases on to our customers.

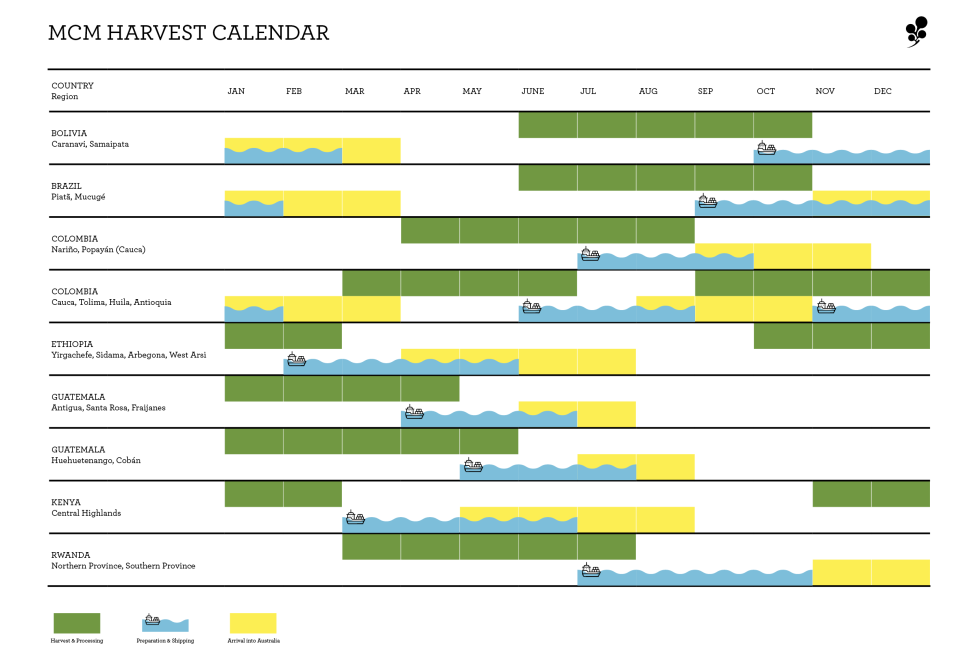

The good news is, we have several containers already booked and en route to Australia! We’re getting ready to add fresh crop lots from Rwanda, Bolivia, Brazil and Colombia to our offer list, with the goal of landing these coffees from November through to early 2025. Starting with our Rwandan lots, which are due to land in a couple of weeks, followed by our Bolivian offerings — largely made up of washed Caturra lots — that will land in early 2025. Our larger Brazilian blending lines are finally on their way and should begin to land next January, with another container out of Colombia hopefully hitting the water before the end of November.

As always, we’ll keep you as up-to-date as possible about potential delays or logistical challenges, so you can make informed decisions about how to manage your own coffee line up. If you haven’t already, now is a great time to book a planning session with us. Our team is on hand to discuss your coffee needs, including important considerations such as profile, volume, pricing and timing — simply shoot us an email or give us a call anytime. We’re here to help!