We answer your questions about rising coffee prices… again!

The price of green coffee has repeatedly risen to historical highs in recent months. Here, we share insights into why prices have surged, how these increases impact MCM’s buying practices and pricing, and what we are doing to help our customers navigate increasing costs.

Published 10 Sep 2024

In late 2021, we shared our thoughts after a spike in the global commodity price for green coffee. While this surge in pricing was largely driven by extreme weather events in Brazil and Colombia, within specialty coffee circles it felt like a long overdue adjustment; one we hoped would lead to higher overall prices and benefit farmers in the long run.

In the three years that have followed, however, market speculation, along with climate change, global inflation and world affairs have continued to dramatically impact the profitability of coffee for farming communities – creating long-lasting challenges with no end in sight.

Over the last nine months, we have seen global commodity prices increase once again, nearly doubling what we saw in 2021 and 2022. In response, we thought it was time to share an updated overview of the cause of the increased price of coffee, the impact on MCM’s buying practices and pricing, and how we are helping our customers navigate increasing costs.

How is the price of most green coffee sold determined?

The reserve price of both Arabica and Robusta is directly tied to the global commodities market, where coffee is traded alongside other agricultural staples like soybeans, wheat, cocoa and sugar. The International Coffee Exchange in New York, which sets the reserve price (or C-price) for Arabica coffee, was established to standardise the crop’s price on a global scale — theoretically giving farmers the assurance that they will receive adequate payment for their coffee. The market responds to the ebbs and flows of supply and demand, as forecasted by traders and influenced by climate events, geopolitics and the global economy.

The C-price fluctuates daily in response to such factors. For example, if Brazil (which produces over 60% of the global supply of Arabica) experiences a low-yielding crop, it is anticipated that demand will exceed supply, driving prices up.

Additionally, coffee pricing is heavily influenced by speculative trading from investors who buy and sell the option to purchase coffee at a specified price at a future date. This ‘secondary’ market allows participants to trade on the perceived value of a contract, without trading the physical stock itself, skewing the market and adding to its volatility.

Speculative trading does not take into consideration the real-life conditions and costs of coffee producers, and does little to guarantee that they are paid fairly, let alone profitably. With most coffee growers lacking the financial muscle or crop volumes to hedge their own stock, the result is a market that, while heavily interconnected, leaves its most important players with little agency or control over the direction it follows.

Why has the price of green coffee risen again this year?

The commodity prices of both Arabica and Robusta coffees have increased to record highs in recent months. Historically, the trade of Robusta and Arabica coffee followed similar, but largely independent trends. With the price of Arabica remaining relatively high since 2021, some coffee buyers have begun to use Robusta as an alternative, linking the two markets more closely. This has attracted investors to the Robusta market, intent on capitalising on its recent surge in pricing, further provoking market volatility and driving the price of Arabica upwards in the process.

There are several key reasons why both Arabica and Robusta markets face a negative outlook:

- Drought conditions in Vietnam have resulted in a much lower 24/25 Robusta crop.

- While Brazil’s 24/25 harvest was predicted to be plentiful, the effects of dry and hot weather at the tail end of the season resulted in lower quality and smaller or underdeveloped beans, negating the benefits of increased yields. This has also occurred in Colombia.

- An ongoing global shortage of agricultural labour, caused by factors like immigration and the increase in more lucrative activities like mining and construction.

- Global demand for coffee increased again in 2024, and is estimated to continue in 2025 — while supply has not kept up.

- Fluctuations of the USD – the currency coffee is traded in – have increased uncertainty in local producing markets. While producers may be paid in currencies like the Colombian peso or Brazilian real, exporters sell in USD — and when its buying power changes drastically overnight, it can create distrust between both parties, or force producers to hold stock until the exchange rate is more beneficial.

- Shipping disruptions at ports affected by the Red Sea conflict have caused a container shortage around the globe and a subsequent increase in freight costs.

How do these factors affect growers?

The factors that affect supply and demand are complex, and are almost always outside of the control of farmers. In countries where the minimum price for coffee cherry or parchment (farmgate) is dictated by the national government, this is doubly so, as that price may be influenced by a need to attract outside investment, or to build up foreign currency reserves. In 2021, the COVID pandemic and its effects had a significant impact on the global supply of coffee. In 2024-5, everything – from inflation to interest rates, the wars in Ukraine and the Middle East, or threats to international free trade agreements, and the costs involved in adapting to a changing climate – is playing a role in destabilising the already shaky commodities market.

The very nature of trading a product that is grown in an increasingly limited number of regions, but sold all over the world, leaves coffee traders susceptible to the effects of global financial markets. For example, if good weather in Vietnam leads to an increase in global Robusta supply, the market price of all coffee will fall. This could place smallholder farmers in Guatemala who grow Arabica coffee (and who may also be experiencing higher costs of production due to climate conditions, currency fluctuations and/or labour shortages) in an extremely vulnerable situation, leading some to abandon coffee and try their hand at a more stable, cost-efficient crop. This, in turn, may lead to a shortage of Guatemalan coffee (increasing its perceived value) or contribute to a global shortage of Arabica, driving buyers to alternative markets and potentially fuelling further demand for Vietnamese Robusta. The cycle is endless and far-reaching.

But doesn’t MCM work outside of the commodities market?

We do, and proudly so! But the impact is still keenly felt across our supply chains. In response to local market spikes, some smallholder producers will choose to sell their crop to more commercially focused exporters, as they are able to receive relatively high prices for their coffee without needing to invest the additional cost, time, and effort required to produce specialty grade coffee. This leaves quality-focused washing stations and exporters, like the ones we work with, needing to pay substantially higher farmgate prices in order to incentivise supply.

If we pay our supply partners a price that allows them to meet their costs and make a profit, it follows that when cost of production increases, so should the price of their coffee. In years when securing labour is competitive, or the base rate for cherry or parchment is inflated, or coffee needs extra processing to meet quality expectations, the increased cost of production is (rightfully) passed on to the buyer.

Ultimately, when the C Market price goes up, producers have the opportunity to make more money from their coffee, which is a great thing! However, when inflation is as elevated as it is right now, the profitability of that gain diminishes. Ensuring the people who grow and process our coffee earn more than just a survivable wage is the only way younger generations will be incentivised to stay in the trade. That’s why, even when prices are higher, we continue to pay well above the market rate – linking prices more directly to the cost of production and the rarity or quality of the coffee – and we believe that this practice can and should be sustained.

What does this mean for the quality (and price) of my coffee?

The quality of the coffees we are cupping and sourcing remains high. At MCM, we don’t compromise on the quality that we import and present to our customers, or on the mutually beneficial nature of our supply partnerships. It is extremely important to continue supporting the coffee-producing communities we buy from and to reiterate the value we place on consistently high-quality, long-lasting coffee lots.

We’re fortunate that, in many cases, our supply partners have been able to stabilise prices for us, based on the long-standing, reciprocal relationships we have maintained over many years. We’ve mirrored their approach for our own customers by adjusting our own margins and managing our costs more efficiently, to keep prices as stable as possible.

That said, we have seen increased pricing for many of the coffees that we purchase. Most of this is directly related to increasing cost of production associated with the effects of climate change and labour shortages. In other cases, particularly in markets where farmgate is determined by local government, independent processing sites or exporters incur a greater cost when sourcing coffee cherry, as they must be competitive to secure the highest quality fruit available. We recognise the challenges increased prices can create for coffee businesses that must watch their bottom line closely to compete in Australia’s price-sensitive market. We anticipate that many of our customers may need to increase prices for wholesale or retail beans, as will cafes for a cup of brewed coffee. This can be a daunting prospect and we want to reassure our customers that we’re here to talk through and help manage those tricky decisions and conversations.

We are still here to help!

While much has changed since we last wrote about coffee pricing, two facts have not: the future of high-quality coffee production is uncertain and unpredictable, and relying on the ready availability of cheap coffee is an unrealistic and unsustainable strategy – both for the coffee buyer and the farming communities whose livelihoods are at stake.

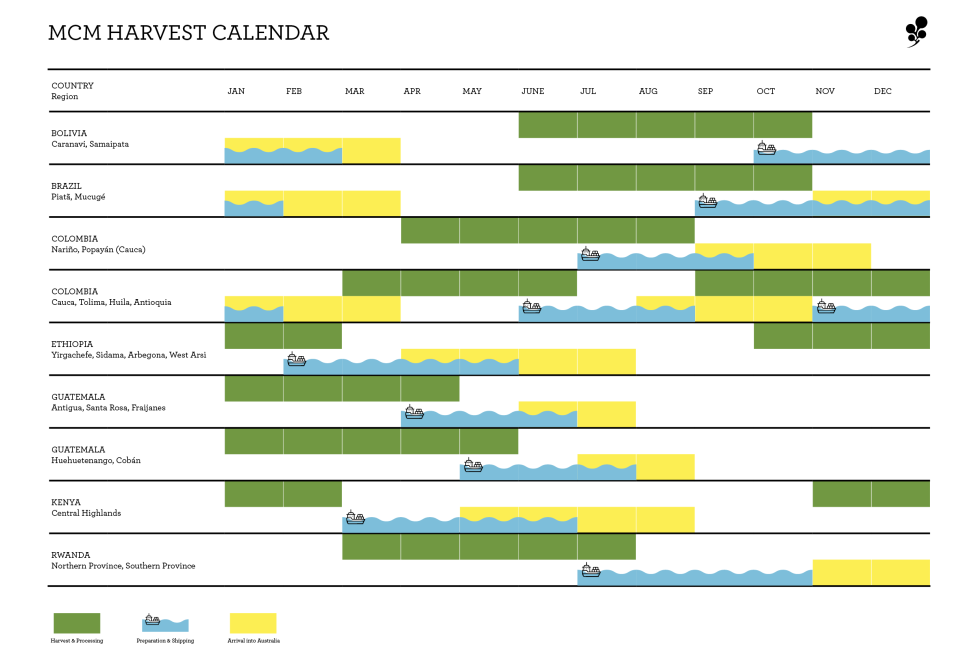

Accepting that the global price of coffee will remain high for the foreseeable future pushes us to find alternative strategies to create efficiencies within our supply chain and to keep our coffee offerings competitive in the market. Over the past three years, we’ve doubled down on our efforts to streamline our logistical and operational practices. This includes landing containers in Perth and Sydney, minimising freight costs for customers in those regions. We’ve explored different packaging options for Brazilian and Colombian blending lines, which brings down cost of production, creating savings that are then passed on to the roasting customer. We believe similar efficiencies can be put in place at the roastery and café by investigating operations and minimising waste – and we’re here to brainstorm ideas if you’d like to chat!

We’ve worked hard to maintain the marketability of our offerings in the Australian industry, with the goal of supporting our supply partners by growing demand for their coffees. Ahead of each buying season, we share a thorough buying brief, including requests from customers for specific price points or volumes. Being kept up to date on pricing trends in Australia allows our partners to explore new producing regions or communities to secure coffees that are more cost efficient (due to factors like favourable weather conditions, access to infrastructure, ease of transport, etc) without compromising on quality or fair pricing. Here in Australia, we take a flexible approach to pricing coffees, dropping our margin for certain regions and offering volume-based price incentives for blending lines. On request, we’re happy to share transparency reports with existing customers, ensuring your confidence in our practices.

One of the key strategies you can take as a roaster is planning your coffee purchasing ahead of time and forward booking your requirements. This creates security in the supply chain: for the producer, a solid, long-term buying relationship gives them confidence to invest at a farm level, resulting in better quality and longevity and, ultimately, contributing to a better livelihood; for our supply partners, an accurate brief – informed by the requests of our customers – allows them to plan ahead for the season and source or process the appropriate coffees required, helping them to manage costs for the season; for MCM, purchasing a coffee with a committed buyer in place is a less risky proposition than buying spot (meaning we can apply a lower margin to the price of that coffee), and allows us to forecast cash flow, leading to better currency management; and for the roaster, forward buying brings consistency and constancy to your supply, as well as significant savings in the price of the coffee.

Finally, we are back to hosting educational, customer-led events (like Let’s Cup! and spotlights on our supply partners or regions we source from), with the goal of getting more people excited about the coffees we offer and fostering support for the people behind them. These events are a great platform to talk about the realities of coffee-growing, including how costly it is, giving attendees more context and perspective. We love holding such events and are always open to planning something with your team and your customers (wholesale or public). We’re here to help, so get in touch anytime to learn more – or scroll below to read up on our business practices.

Further Reading:

Why transparency is important (and difficult) and what we’re doing about it